Despite the current challenges in cross-chain adoption, with only 13% of Ethereum Virtual Machine (EVM) addresses having transacted across chains, Axelar’s recent innovations have the potential to transform this sector.

Axelar’s appeal is driven by its core features: the Interchain Token Service (ITS) and General Message Passing (GMP). These tools streamline the development of decentralized applications (dApps) that operate across multiple blockchains, positioning Axelar as a seamless framework for building multichain applications.

ITS automates token creation that functions seamlessly across supported EVM chains, removing the need for complex bridging processes. GMP allows developers to invoke functions across protocols, simplifying cross-chain interoperability to the level of single-chain development.

Axelar’s cross-chain solution seems to be gaining traction among developers and users. On-chain data shows that Axelar has seen significant growth in GMP and ITS usage, increasing by over 31,000% since October 2023.

With over 270,000 unique users, Axelar is gaining significant traction in the broader crypto community. Its performance in the Ethereum ecosystem is especially remarkable, surpassing competitors like Wormhole and LayerZero in terms of usage.

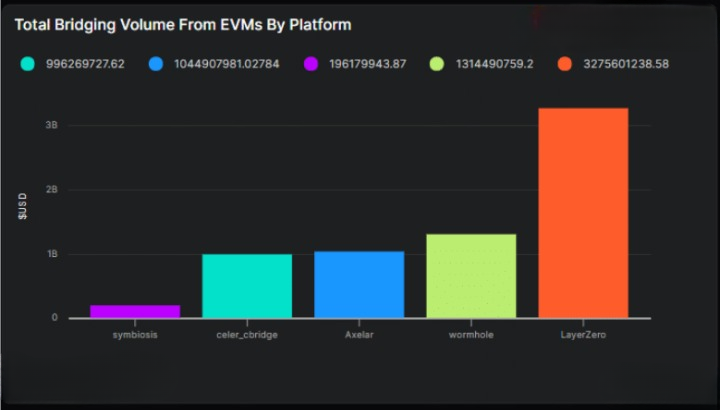

While Axelar may trail behind LayerZero and Wormhole in total bridging volume, it is steadily establishing a strong position in the cross-chain competition.

LayerZero currently maintains a lead with bridging volume exceeding $3 billion. Meanwhile, Axelar has solidified its standing just behind Wormhole, boasting a bridging volume of over $1 billion. It’s worth noting that Axelar’s actual bridging volume might be higher, considering non-EVM chains within its ecosystem that may not be fully reflected in comparative data.

Axelar’s sustained growth is significantly fueled by the Squid Router, an advanced cross-chain swap engine pivotal to most GMP transactions. With a remarkable bridging volume exceeding $830 million, Squid seamlessly integrates with top decentralized exchanges like dYdX and PancakeSwap, offering efficient cross-chain swaps and conversions.

The impact of Squid’s capabilities is evident in Axelar’s growth trajectory, closely tracking the surge in GMP and ITS usage. This correlation highlights Squid’s integral role in contributing to Axelar’s overall success.

Furthermore, Axelar has strategically positioned itself as a secure and decentralized solution, effectively addressing concerns prevalent in many cross-chain protocols. Boasting a fully decentralized validator set comprising over 75 validators, Axelar stands in stark contrast to LayerZero’s reliance on oracles and Wormhole’s permissioned validator set.

Additionally, the report highlighted Axelar’s commitment to accessibility, ensuring that developers can seamlessly adopt a multichain-by-default approach, thereby assisting decentralized applications (dApps) in overcoming the complexities of cross-chain functionality.

The report noted, “Currently, centralized onboarding manages the majority of cross-chain activity. However, as decentralized alternatives mature, we may witness a significant expansion in interoperability protocols, spearheaded by Axelar.”