The Dream of Homeownership: A Fundamental Aspect of the American Dream, Signifying Stability, Security, Progress, and Success. Nonetheless, for young millennials and Generation Z, this ambition has transformed into an elusive dream overshadowed by the harsh reality of soaring costs, predatory fees, and a complex system filled with opaque practices and potential exploitation. Yet, a solution is emerging within the Web3 movement.

Challenges to Conventional Homeownership

Obstacles to Traditional Homeownership: A Burden Disproportionately Affecting Younger Generations. Predatory fees, inflation, high interest rates, broker commissions, and a general lack of transparency create a significant financial strain, making it even more challenging to save for a down payment.

Additionally, concerns about potential fraud, corporate competition, and market monopolies raise doubts about the trustworthiness of real estate transactions, adding to the complexity of the housing market.

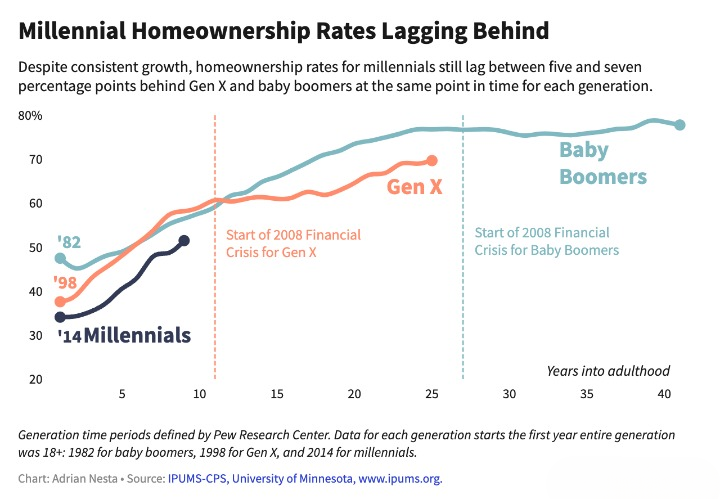

The complexity of navigating this challenging environment can be overwhelming for many young individuals. Consequently, homeownership rates among millennials and Gen Z have declined compared to previous generations, exacerbating economic inequality and perpetuating financial disenfranchisement.

A Crucial Legal Development in Real Estate: The National Association of Realtors (NAR) has reached a substantial $418 million settlement in a class-action lawsuit alleging the industry’s artificial inflation of real estate commissions, a violation of antitrust laws. This legal action underscores the urgent call for transparency and the reduction of redundant fees, paving the way for innovative solutions such as tokenization.

Tokenizing Property: The Blockchain Solution

Tokenizing Real Estate: Revolutionizing Property Transactions through Blockchain.

Tokenization involves converting assets into digital tokens on a blockchain, promising transformative changes in the real estate sector’s buying, selling, and financing processes.

By eliminating intermediaries like brokers, tokenization reduces overhead costs and transactional expenses, leading to lower fees. Furthermore, blockchain technology enhances transparency, security, and efficiency in transactions, mitigating fraud risks and fostering trust among stakeholders.

Tokenization not only streamlines operations but also enables fractional ownership, allowing more individuals to invest in real estate with reduced upfront capital requirements.

The Emergence of Tokenizing Real-World Assets

Tokenization is making waves beyond specialized markets, becoming a dominant force in the wider financial arena. A prime example is BlackRock’s debut in tokenized assets through its inaugural tokenized Treasury fund, experiencing an astounding surge in value from $100 million to nearly $1.3 billion swiftly. This remarkable growth highlights the surging confidence and enthusiasm for blockchain’s role in traditional asset management. It showcases how tokenization can expedite settlements, enhance transparency, and optimize operational processes.

The substantial growth witnessed in the Treasury market due to tokenization serves as a testament to the technology’s potential to reshape financial norms. Similarly, in the real estate sector, tokenization offers a compelling proposition, democratizing property investment and harmonizing it with contemporary financial paradigms.

Enabling liquidity in previously illiquid assets empowers property owners to unlock the value of their holdings without resorting to traditional sales. Platforms facilitating peer-to-peer trading of real estate tokens provide owners with the flexibility to monetize their properties according to their preferences, including fractional sales, leasing arrangements, or innovative mechanisms. This enhanced liquidity injects a fresh vibrancy into the real estate market, boosting its ability to withstand economic fluctuations and adapt swiftly.

Making Real Estate Investment Accessible

Tokenizing real estate has the potential to democratize access to investment opportunities, allowing individuals from diverse backgrounds to participate in property ownership and wealth building. This breakthrough can level the playing field and create a more inclusive environment in the real estate market.

However, the widespread adoption of real estate tokenization faces challenges such as regulatory complexities, technological limitations, and resistance from established interests. Policymakers need to engage actively with stakeholders to establish a regulatory framework that promotes innovation while safeguarding consumer interests. This framework should uphold stringent standards of transparency, security, and compliance to ensure trust and confidence in tokenized assets.

Tokenizing real estate presents a revolutionary chance to revolutionize property transactions, investment, and ownership. Leveraging blockchain’s capabilities, we can dismantle the longstanding barriers that hindered access to homeownership, fostering a housing market that is more affordable, transparent, and inclusive for future generations.