BounceBit, a fresh Bitcoin restaking venture supported by Binance, has revealed its 2024 roadmap, detailing pivotal elements the project aims to execute within the year.

On May 20, through a Medium blog post, BounceBit declared its ambition to merge the framework and fluidity of centralized exchanges akin to Coinbase, all while constructing decentralized infrastructure for Bitcoin, maintaining its core technology intact. The startup expressly mentioned its decision against introducing a sidechain or layer-2 solution, asserting that recent trends such as runes and BRC-20 tokens appear to exploit transient excitement rather than catering to enduring requirements.

“You might not agree, the market might not agree, and that’s fine, we are venturing this road anyway.” – BounceBit

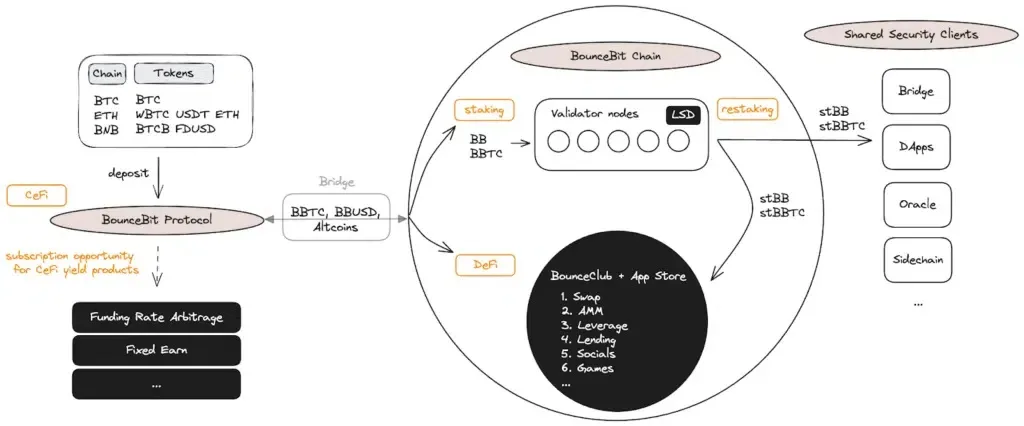

While BounceBit’s 2024 roadmap doesn’t specify dates, it highlights several significant advancements planned for the year. The company’s objective is to elevate the BounceBit Chain – a proof-of-stake layer-1 chain safeguarded by validators staking both Bitcoin and BounceBit’s native token BB – by refining the Ethereum Virtual Machine (EVM) execution layer to enhance node performance.

Additional enhancements in the pipeline encompass crafting a shared security client module, facilitating other ventures to harness the liquidity of the BounceBit BTC restaking chain, crafting a novel mempool module to bolster transaction throughput, and restructuring the communication layer linking EVM and Cosmos SDK, a framework tailored for blockchain network development.

Alongside infrastructure upgrades, BounceBit is set to unveil its Fixed Earn product, providing a fixed income avenue for Bitcoin and dollar assets, mirroring traditional crypto lending offerings. Additionally, the company will roll out BounceClub, a platform empowering users to fashion their own centralized-decentralized-finance (cedefi) products via BounceBit’s widget. Regarding contract deployment, BounceBit will implement a specialized whitelist, although the verification method remains undisclosed at present.

In April, Binance Labs, the investment division of Binance, revealed its backing of BounceBit, without disclosing the deal’s magnitude. Yi He of Binance Labs emphasized that the startup facilitates fresh opportunities for Bitcoin’s application by blending centralized finance (cefi) and decentralized finance (defi).