In the last 24 hours, BTC saw a 0.7% decline, currently priced at $66,500. Its market cap teeters close to $1.3 trillion. Despite this, daily trading volume surged by 40%, hitting $22.2 billion.

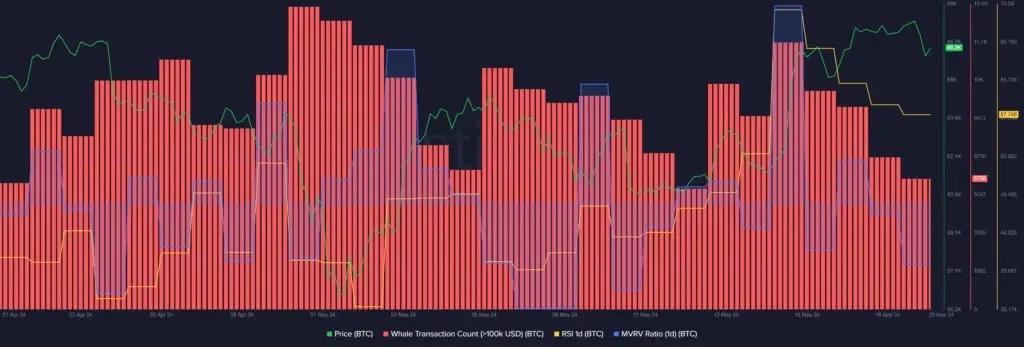

Furthermore, the drop in BTC price coincides with a decrease in whale activity. Santiment’s data reveals a 51% decline in whale transactions involving at least $100,000 worth of BTC over the last five days, reducing from 11,757 transactions on May 15th to 5,756 transactions daily at the current reporting time.

Similarly, the Bitcoin Relative Strength Index (RSI) has shown a consistent decline mirroring the asset’s decrease in whale activity. According to the market intelligence platform, the Bitcoin RSI dropped from 70 to 57 over the last five days.

The indicator suggests that Bitcoin has moved out of the overvalued territory, hinting at the possibility of a price increase.

At this price level, the decrease in whale activity and RSI would imply reduced price volatility for the leading cryptocurrency by market capitalization.

Per Santiment’s data, the BTC Market Value to Realized Value (MVRV) ratio stands at 143%, equivalent to 2.86x, currently. This significant metric indicates that the average price of all Bitcoins obtained thus far has risen by 143% at this juncture.

Furthermore, the BTC MVRV ratio has decreased from 146% in the last three days. Historically, Bitcoin holders tend to await a price surge before considering selling their assets when the MVRV ratio drops.