The National Payments Corporation of India (NPCI) recognizes that there are situations when we urgently need cash but don’t have our ATM card with us. Fortunately, most of us carry our smartphones with us almost all the time. To address this, NPCI has introduced UPI ATM cash withdrawal capabilities, aiming to simplify the process of cardless cash withdrawals at ATMs, especially in emergencies.

This feature, known as Interoperable Cardless Cash Withdrawal (ICCW), enables you to effortlessly use your smartphone and preferred UPI app to withdraw cash from ATMs. Read on to discover how you can make UPI-enabled cash withdrawals at ATMs.

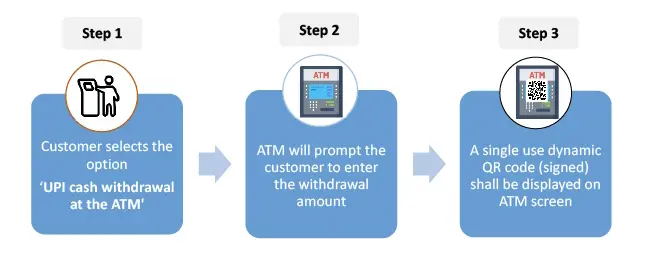

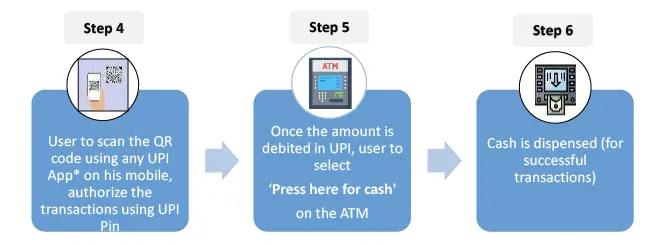

A Step-by-Step Guide for UPI ATM Cash Withdrawal

To withdraw cash from a UPI-compatible ATM using your preferred UPI app, follow these steps:

- Select the “UPI Cardless Cash” or “UPI Cash Withdrawal” option from the on-screen menu.

- Enter the desired withdrawal amount, which may be available in denominations like 100, 500, 1,000, 2,000, and 5,000, depending on the ATM.

- The ATM will generate a single-use QR code for the chosen withdrawal amount.

- Use any UPI app installed on your iPhone or Android phone to scan the QR code.

- Authorize the transaction by entering your UPI PIN.

- The ATM will dispense your cash, and you’ll receive a confirmation notification in your selected UPI app.

- Don’t forget to collect your cash before leaving the ATM kiosk.

Additionally, the NPCI has collaborated with Hitachi Payment Services to introduce the first UPI ATM in India. This White Label ATM, known as the Hitachi Money Spot UPI ATM, supports QR-based cardless cash withdrawal.

Distinguishing UPI ATM from Cardless Cash Withdrawal

UPI-based cash withdrawal offers a seamless experience similar to cardless cash withdrawal, but with a notable distinction. Unlike cardless cash withdrawal, you are not required to provide your phone number or rely on OTPs for transaction verification. Instead, when using UPI ATM functionality, you simply scan the displayed QR code using your smartphone. Union Minister Piyush Goyal shared a video on X (formerly Twitter) demonstrating this feature.

Furthermore, when utilizing UPI ATMs, the withdrawal limit is capped at Rs 10,000. Additionally, you can easily switch between different accounts through your installed UPI app. It’s important to note that cash withdrawal from these ATMs will count toward your existing daily UPI transaction limit, so exercise caution when withdrawing funds.

0 Comments