In December 2022, Eisenberg faced arrest in Puerto Rico on charges of commodities fraud, market manipulation, and wire fraud tied to the Mango Markets breach. The exploit took place in October 2022 when Eisenberg injected $5 million of USDC stablecoin into Mango Markets.

As per court revelations, Eisenberg manipulated the price of MNGO, the platform’s token, leading to a sudden surge of approximately 1,000% within an hour. This orchestrated spike enabled him to borrow and withdraw extra tokens, resulting in a substantial negative debt position for the platform.

Shortly after the breach, Eisenberg asserted that his actions constituted a legitimate, highly lucrative trading strategy, leveraging the platform’s functionalities as intended. Subsequently, he refunded $67 million to Mango Markets, while retaining $47 million based on a community governance decision.

The trial, commencing on April 9, lasted slightly over a week. Throughout the proceedings, Eisenberg’s defense contended that he utilized a lawful trading approach. Nevertheless, prosecutors characterized his actions as fraudulent, as reported by Bloomberg.

In court, a customer from the UK testified that they were unable to withdraw funds, resulting in a loss of $124,000.

The customer emphasized, “That’s not how DAOs operate. There’s no one to contact,” highlighting the decentralized nature of these platforms.

According to Bloomberg, jurors were presented with evidence showing Eisenberg’s online searches for terms related to market manipulation crimes and FBI surveillance. As a result of the exploit, Mango Markets incurred a loss of approximately $116 million.

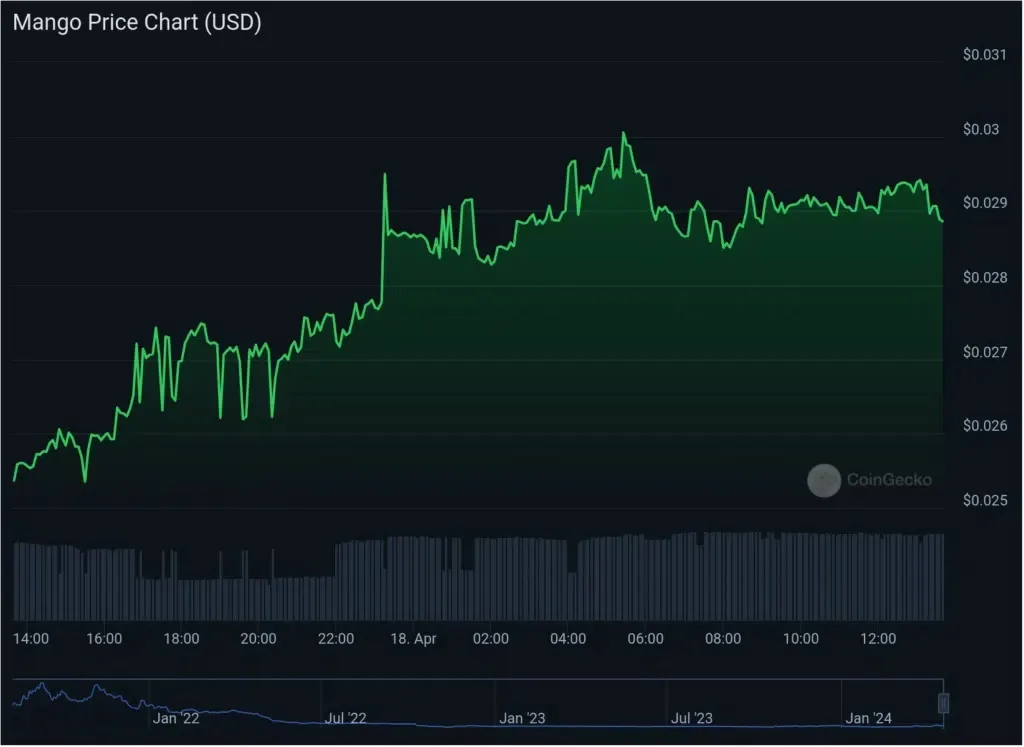

MNGO’s price has surged by 14% in the last 24 hours, reaching $0.0289, as reported by CoinGecko.

Avraham Eisenberg’s conviction in the $110 million Mango Markets exploit has sparked discussions and raised questions about the implications of such actions. The news has left many wondering about the security of digital assets and the potential risks involved in the cryptocurrency market. What are your thoughts on this development? Do you believe it will have a significant impact on the crypto space? Let us know in the comments below.